NLP Tools for Text Analysis

NLP Tools for Text Analysis

- NLP tools automate the analysis of text for patterns and sentiments.

- They include features for text mining, sentiment analysis, and language interpretation.

- Key tools offer scalability, accuracy, and integration with various platforms.

- Used widely in marketing, finance, healthcare, and research.

- They address challenges like linguistic nuances and privacy concerns.

- Future trends point towards advanced AI integration and real-time analysis capabilities.

NLP, Text Mining, and Sentiment Analysis

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on interacting with computers and humans through natural language.

The goal is to read, decipher, understand, and make sense of human languages in a valuable way. NLP is crucial for text analysis, enabling machines to process and analyze large amounts of natural language data.

Text Mining involves extracting interesting and non-trivial patterns or knowledge from unstructured text data. It employs a variety of methodologies and techniques from NLP and data mining to accomplish tasks such as:

- Summarization

- Classification

- Clustering

Sentiment Analysis is a key application of NLP. It focuses on identifying and categorizing opinions expressed in a text. It aims to determine the writer’s attitude towards particular topics or the overall contextual polarity of the document.

Sentiment analysis helps in the following:

- Understanding customer opinions

- Monitoring brand reputation

- Gathering insights from social media

Key Features of Effective NLP Tools

Effective NLP tools are distinguished by several critical features that enhance their utility and effectiveness in processing and analyzing text data.

These features include:

- Automation of Text Analysis Tasks: These tools automate the extraction of meaningful information from text, enabling efficient analysis of large datasets without manual intervention.

- Accuracy in Interpreting Nuances of Human Language: High-quality NLP tools are adept at understanding the complexities and nuances of language, including slang, idioms, and varying syntax, which are essential for accurate analysis.

- Scalability to Handle Large Volumes of Text: Scalability ensures that NLP tools can process and analyze data sets of any size, catering to the needs of both small projects and big data applications.

- Integration Capabilities with Other Software and Platforms: To maximize their utility, NLP tools often integrate various databases, analytics platforms, and software ecosystems, allowing for a seamless workflow in data analysis projects.

By focusing on these key features, NLP tools unlock the potential to transform raw text into actionable insights, driving informed decision-making across various domains.

Top 10 NLP Tools for Text Mining and Sentiment Analysis

In today’s data-driven world, the power of Natural Language Processing (NLP) is indispensable for gleaning insights from unstructured text data.

From analyzing customer feedback to monitoring social media sentiment, NLP tools have become vital for businesses across sectors.

We present an in-depth look at the top 10 NLP tools designed for text mining and sentiment analysis, ensuring your business stays ahead of the curve by leveraging the most advanced technologies available.

1. Monkey Learn

Monkey Learn stands out with its user-friendly interface, making NLP accessible even to those without a background in data science. It specializes in text classification, sentiment analysis, and extracting actionable insights from text data.

- Key Features:

- Pre-trained models for quick deployment

- Custom model capabilities for tailored insights

- Seamless integration with popular business tools

- Industry Application: Marketing, customer support, and product feedback analysis.

2. Aylien

Aylien leverages advanced AI to offer deep insights from news content, making it ideal for media monitoring and market research.

- Key Features:

- Comprehensive news API for real-time monitoring

- Text analysis capabilities, including sentiment analysis and entity recognition

- Multilingual support for global coverage

- Industry Application: Public relations, finance, and market research.

3. IBM Watson

IBM Watson is renowned for its robust AI and machine learning features, providing businesses with a wide range of NLP services.

- Key Features:

- Advanced sentiment analysis

- Natural language understanding for deeper insights

- Extensive document analysis capabilities

- Industry Application: Healthcare, finance, and customer service.

4. Google Cloud NLP

Google Cloud NLP harnesses Google’s machine-learning expertise to offer powerful text analysis capabilities.

- Key Features:

- State-of-the-art sentiment analysis

- Entity recognition and content classification

- Integration with Google Cloud services

- Industry Application: Content management, marketing analysis, and e-commerce.

5. Amazon Comprehend

Amazon Comprehend provides a seamless way to integrate complex NLP tasks into applications powered by AWS’s robust infrastructure.

- Key Features:

- Real-time and batch text processing

- Keyphrase extraction and sentiment analysis

- Medical information analysis with a specialized version

- Industry Application: Healthcare, customer feedback analysis, and compliance monitoring.

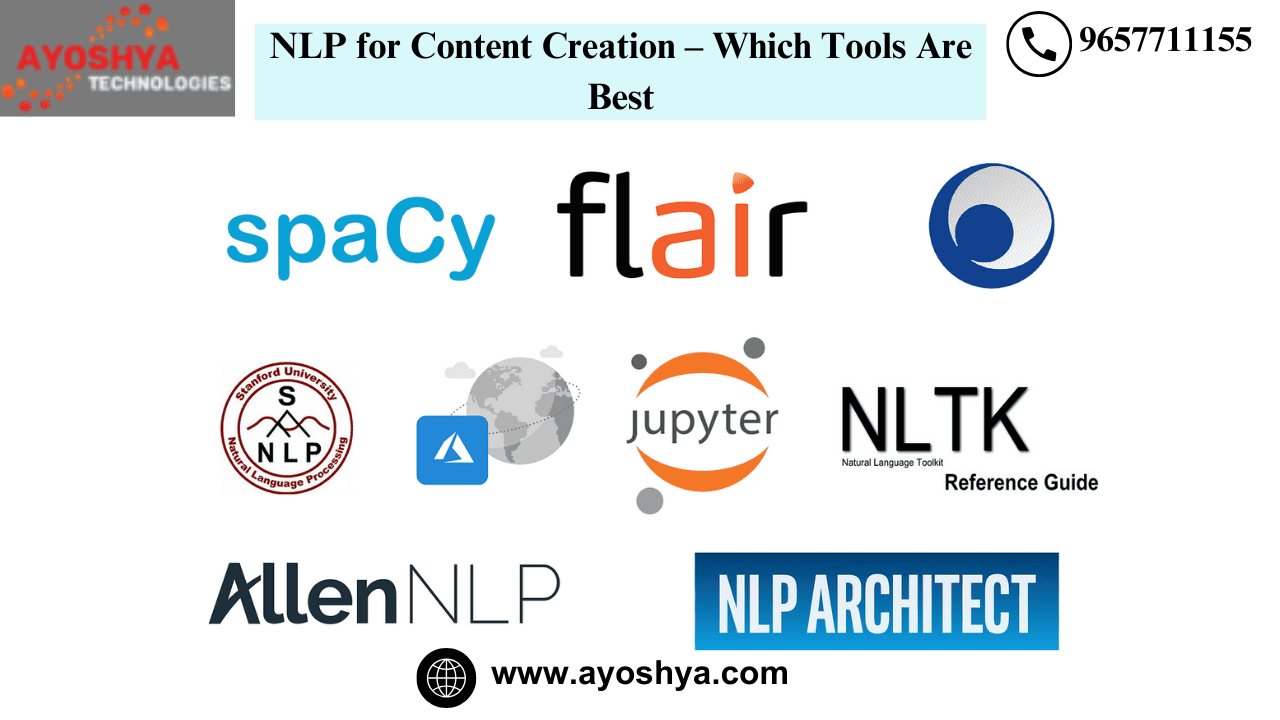

6. NLTK (Natural Language Toolkit)

NLTK is a popular open-source library in Python, offering a wide range of tools and resources for building NLP applications.

- Key Features:

- Comprehensive library for text processing

- Support for classification, tokenization, stemming, and tagging

- Active community and extensive documentation

- Industry Application: Education, research, and development projects.

7. SpaCy

SpaCy is a modern, fast NLP library for Python known for efficiently handling large volumes of text.

- Key Features:

- High-speed processing and accuracy

- Pre-trained models for multiple languages

- Easy model customization and extension

- Industry Application: Content extraction, language understanding, and product categorization.

8. Stanford Core NLP

Developed by Stanford University, Stanford Core NLP is a toolkit offering a range of grammatical analysis tools.

- Key Features:

- Robust tools for linguistic analysis

- Integration capabilities with various programming languages

- Support for multiple languages

- Industry Application: Academic research, text analytics, and data extraction.

9. Text Blob

Text Blob simplifies text processing in Python, providing an intuitive API for common NLP tasks.

- Key Features:

- Easy to use for beginners

- Sentiment analysis, POS tagging, and noun phrase extraction

- Extensions for language translation and spelling correction

- Industry Application: Educational projects, prototype development, and sentiment analysis.

10. Gensim

Gensim is renowned for its ability to handle large text corpora, offering efficient algorithms for topic modeling and document similarity.

- Key Features:

- Scalable to large datasets

- Efficient implementations of market-leading algorithms

- Focus on unsupervised topic modeling and document similarity

- Industry Application: Document management, recommendation systems, and market research.

Leveraging these NLP tools can transform your business’s approach to data analysis, offering nuanced insights that drive decision-making and strategic planning.

Whether you’re analyzing customer sentiment, researching market trends, or developing intelligent systems, these tools can extract meaningful information from complex text data.

Criteria for Selecting NLP Tools

Selecting the right NLP tools for your business or project involves more than picking the most popular option.

It requires a thoughtful consideration of various factors that will impact the effectiveness, integration, and overall success of the NLP application in your workflows.

Below, we detail the key criteria to guide your selection process, ensuring you choose tools that align with your specific needs and objectives.

Accuracy and Reliability

- What to Look For: Tools should deliver high precision and recall rates in their analyses. Look for evidence of rigorous testing, validation against real-world datasets, and peer reviews or case studies demonstrating successful applications.

- Why It Matters: The foundation of any data-driven decision-making is the quality of insights derived. Accuracy ensures that the patterns, trends, and predictions you base your decisions on reflect the true nature of the data.

User Interface and Ease of Use

- What to Look For: An intuitive, user-friendly interface that allows technical and non-technical users to operate the tool efficiently. Ease of use is crucial for teams to adopt and fully leverage the capabilities of NLP tools.

- Why It Matters: A steep learning curve can hinder adoption and reduce the potential benefits of the tool. Ease of use ensures broader acceptance and more effective, widespread application across your organization.

Support for Multiple Languages

- What to Look For: The ability to analyze and interpret data in various languages can be critical, especially for global businesses. Check for support for the languages relevant to your audience or data sources.

- Why It Matters: Multilingual support expands the tool’s applicability across different geographical markets and datasets, enabling a more comprehensive understanding of global customer sentiment and behaviors.

Cost and Licensing Options

- What to Look For: Understand the pricing structure, including tiered subscription plans, one-time fees, or usage-based pricing. Review the licensing agreement for any restrictions or obligations impacting your tool use.

- Why It Matters: Budget considerations, such as the flexibility to scale usage up or down based on needs, are paramount. A clear understanding of costs and licensing terms helps in planning and avoids unexpected expenses.

By carefully considering these criteria, you can ensure that the NLP tools you select meet your immediate needs and offer the potential to scale and adapt as your requirements evolve.

The right tools will provide actionable insights, enhance operational efficiency, and contribute to more informed decision-making processes across your organization.

Real-Life Use Cases of NLP Tools in Marketing and Social Media

The fusion of Natural Language Processing (NLP) tools with marketing and social media strategies has revolutionized how brands interact with their audience, manage their reputation, and harness customer feedback.

Below, we explore this synergy through real-life examples, highlighting the use cases, industries that have benefited, and the specific tools or technologies leveraged to achieve these outcomes.

Tracking Brand Sentiment and Customer Feedback

- Use Case: Companies increasingly use NLP tools to monitor and analyze customer sentiment across various social media platforms and feedback channels. This approach enables businesses to understand public perception of their brand, products, or services in real time.

- Industry: This application is widespread but particularly significant in the retail, entertainment, and service industries, where customer sentiment can quickly influence brand reputation and consumer decisions.

- Benefits:

- Immediate Insight into Customer Sentiment: Brands can gauge public reaction to new product launches, marketing campaigns, or company news, allowing for rapid response to customer concerns or market trends.

- Enhanced Customer Experience: By understanding customer feedback and sentiment, companies can tailor their products, services, and communication strategies to better meet the needs and preferences of their target audience.

- Proactive Reputation Management: Monitoring brand sentiment helps companies address negative feedback swiftly, mitigating potential damage to their reputation.

- Tools and Technology:

- MonkeyLearn: Utilized for its sentiment analysis capabilities, MonkeyLearn allows brands to automatically classify text as positive, negative, or neutral, making it easier to track overall brand sentiment.

- Brandwatch: A comprehensive tool for social media monitoring, Brandwatch provides deep insights into brand mentions, sentiment trends, and the impact of social media campaigns.

- Hootsuite Insights: Powered by Brandwatch, this tool offers real-time monitoring of social media conversations, enabling brands to monitor what’s being said about them across various platforms.

Each tool employs advanced NLP algorithms to sift through the vast amount of unstructured data on social media and other digital platforms, transforming it into actionable insights.

By leveraging these technologies, companies can stay ahead in the fast-paced digital marketing landscape, ensuring their strategies resonate well with their audience and their brand reputation remains strong.

This use case exemplifies the power of NLP in extracting valuable insights from natural language, showcasing its critical role in modern marketing strategies and customer relationship management.

As NLP technologies evolve, we expect even more innovative applications to emerge, further transforming the marketing and social media domains.

Real-Life Use of NLP Tools in Finance: Analyzing Market Sentiment for Investment Strategies

Use Case Overview

Accurate gauging of market sentiment is crucial for developing effective investment strategies in finance.

Market sentiment refers to the overall attitude of investors toward a particular security or financial market. I

It’s an aggregate of multiple factors, including news articles, expert opinions, social media discussions, and financial reports, which can influence investment decisions and market movements.

Industry Application

This application is widely used in the finance sector, encompassing investment firms, hedge funds, and individual traders.

Financial analysts can predict market trends by analyzing market sentiment, identifying investment opportunities, and mitigating risks.

Benefits

- Enhanced Decision-Making: Real-time sentiment analysis gives investors a nuanced understanding of the market, enabling them to make informed decisions.

- Risk Mitigation: Understanding the emotional tone behind market movements helps anticipate volatility, allowing for strategies that minimize potential losses.

- Competitive Advantage: Access to sophisticated sentiment analysis tools gives investors an edge over those relying solely on traditional financial indicators.

Tools and Technology Used

- Text Analytics Platforms: Tools like Aylien and IBM Watson are adept at extracting sentiment from financial news and reports, employing deep learning to understand the nuances of finance language.

- Social Media Monitoring Tools: Platforms such as Brandwatch and Awario delve into social media conversations, forums, and blogs to capture the public’s mood regarding market conditions, specific stocks, or the economy in general.

- Algorithmic Trading Software: Integrating NLP tools with algorithmic trading systems allows for the automation of trading strategies based on sentiment indicators. Tools like Gensim and NLTK can be customized to analyze large datasets from financial documents and provide inputs for these trading algorithms.

- Market Research Tools: Specialized NLP applications in market research tools can analyze sentiment trends over time, providing historical context to current market sentiments, which is crucial for long-term investment planning.

In conclusion, NLP tools transform finance by enabling more nuanced and dynamic investment strategies.

By leveraging the power of language processing and sentiment analysis, investors can navigate the market’s complexities with greater insight and precision.

As NLP technology continues to evolve, its integration into financial analysis and strategy development is expected to deepen, further enhancing the capabilities of financial professionals and the performance of investment portfolios.

Real-Life Use of NLP Tools in Healthcare: Extracting Patient Information from Clinical Notes for Better Care Management

Use Case Overview

In the healthcare sector, the efficient management and analysis of clinical notes—ranging from doctors’ observations to patient histories and treatment plans—are critical for delivering high-quality care.

NLP tools are revolutionizing the handling of this data by extracting relevant patient information from unstructured clinical notes.

This process facilitates a more nuanced understanding of a patient’s health status, contributing to personalized and timely care.

Industry Application

This application is crucial across various healthcare settings, including hospitals, clinics, and research institutions.

Healthcare professionals and medical researchers leverage NLP tools to process vast amounts of textual data quickly, which would otherwise be time-consuming and prone to human error if done manually.

Benefits

- Improved Patient Care: By efficiently analyzing clinical notes, healthcare providers can make more informed decisions, leading to better patient outcomes.

- Enhanced Data Management: Automating patient information extraction helps organize electronic health records (EHRs) more effectively, making data retrieval faster and more reliable.

- Facilitated Research and Development: Researchers can use extracted data to identify trends, evaluate treatment outcomes, and contribute to medical research, leading to advances in healthcare.

Tools and Technology Used

- Amazon Comprehend Medical: This NLP service extracts relevant medical information from unstructured text, including conditions, medications, and treatment outcomes. It’s specifically tailored for healthcare applications and ensures compliance with data privacy standards.

- IBM Watson Health: Utilizes advanced NLP capabilities to analyze medical literature and patient data. It supports healthcare professionals by providing insights into patient care, research, and population health management.

- Stanford NLP Group’s Clinical Text Analysis: Developed by the Stanford NLP Group, this toolkit is designed for processing and understanding medical texts. It includes models trained on clinical notes and identifying medical entities and relationships.

- Google Cloud Healthcare API: Integrates NLP with other Google Cloud services to extract insights from EHRs. It facilitates clinical text analysis for insights into diagnoses, treatments, and patient sentiment.

By integrating NLP tools into healthcare processes, the industry can leverage the rich information in clinical notes, leading to improved care management, operational efficiencies, and the acceleration of medical research.

As these technologies continue to evolve, their impact on patient care and the healthcare system is expected to grow, marking a significant advancement in how medical information is utilized for the benefit of patients and providers alike.

Real-Life Use of NLP Tools in Research and Academia: Facilitating Literature Review and Research Analysis

Use Case Overview

The academic and research sectors are inundated with vast data from published papers, articles, and journals.

NLP tools are pivotal in managing this deluge, enabling scholars and researchers to conduct comprehensive literature reviews and analyses efficiently.

NLP facilitates deeper insights and discoveries by automating the extraction and synthesis of information from extensive textual datasets.

Industry Application

This application spans all academic disciplines, from the sciences and engineering to the humanities and social sciences.

Researchers, academics, and students leverage NLP tools to streamline the literature review process, identify research gaps, and analyze textual data for various studies.

Benefits

- Efficient Data Processing: NLP tools significantly reduce the time required to review literature, allowing researchers to process and analyze documents at an unprecedented scale.

- Enhanced Insight Discovery: Automated analysis helps uncover patterns, trends, and connections that might not be immediately apparent, leading to novel insights and hypotheses.

- Improved Research Productivity: By automating the labor-intensive parts of the literature review and analysis, researchers can focus more on hypothesis formation, experiment design, and writing.

Tools and Technology Used

- Gensim: Popular for its topic modeling capabilities, Gensim is used in academia to discover the underlying themes in large collections of documents, making it easier to categorize and summarize research findings.

- Mendeley: While primarily a reference manager, Mendeley uses NLP to help researchers organize their literature, discover new research, and collaborate online with others in their field.

- NVivo: Offers powerful text analysis features, enabling researchers to code and extract insights from qualitative data. Its NLP capabilities facilitate thematic analysis and sentiment analysis in large datasets.

- SciPy and NLTK: These Python libraries are instrumental for computational linguistics and natural language processing researchers. They provide tools for text manipulation, corpus analysis, and linguistic data visualization.

- Elsevier’s SciVerse is an application suite that integrates NLP to enhance search functionality, enabling more effective discovery and analysis of academic literature.

By integrating NLP tools into their workflow, the academic and research communities can more easily and precisely navigate the vast ocean of available data.

These technologies not only streamline the research process but also open up new avenues for discovery and innovation, reinforcing the importance of NLP in advancing knowledge and scholarly work.

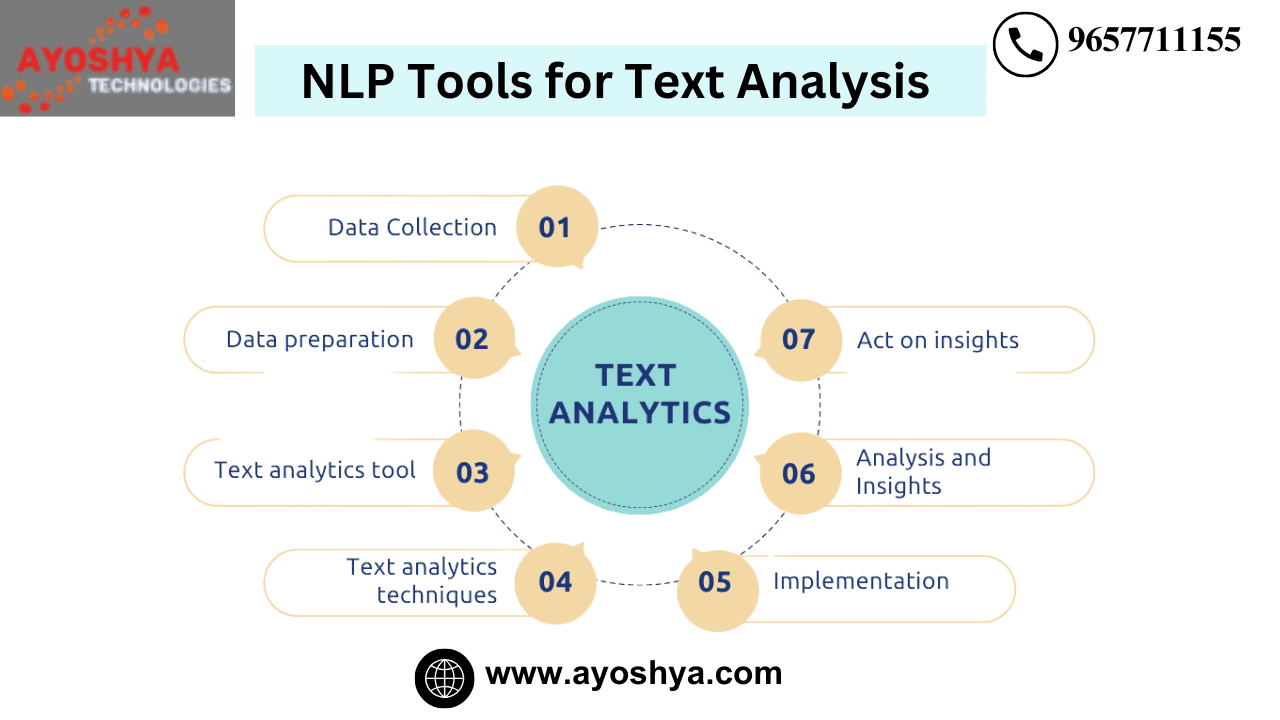

Guide for organizations looking to leverage NLP tools for text analysis

This guide will walk you through starting points, identifying use cases, and implementing NLP tools effectively.

1. Understanding Your Needs

Assess Your Objectives: Define what you hope to achieve with NLP. Are you looking to improve customer service through sentiment analysis, enhance product recommendations, or automate data entry from unstructured text? Your objectives will guide your choice of tools.

Identify Your Data Sources: Determine where your text data is coming from. This could be social media, customer feedback, internal documents, or online articles. The nature of your data sources will influence the NLP features you need.

2. Exploring NLP Use Cases

To identify relevant use cases:

- Research Industry Applications: Look into how other organizations in your sector use NLP. This can offer insights into potential applications and benefits.

- Consider Cross-Industry Inspirations: Don’t limit your exploration to your industry. Applications in one field can often be adapted to another, offering innovative use cases.

3. Choosing the Right NLP Tools

Evaluate Tool Capabilities:

- Look for tools that align with your specific needs. This might include language support, ease of integration, real-time processing capabilities, and the ability to handle the volume and variety of your data.

- Trial and Experiment: Many NLP tools offer free trials or demo versions. Use these to experiment with different tools to find the one that best suits your needs.

Consider the Learning Curve:

- Tools vary in complexity. When choosing an NLP solution, consider your team’s technical expertise and available training resources.

4. Implementing NLP in Your Workflow

Start Small and Scale: Begin with a pilot project focused on a specific use case. This allows you to measure the impact of NLP and adjust your strategy as needed before scaling up.

Integrate NLP with Existing Systems: NLP tools should work seamlessly with your existing software and systems for maximum impact. This might require custom integrations or the assistance of specialists.

5. Measuring Success and Iterating

Establish KPIs: Based on your objectives, define clear metrics for success. These could include increased customer satisfaction scores, reduced processing times, or improved sales conversions.

Gather Feedback and Iterate: NLP is not a “set it and forget it” solution. Regularly review your KPIs, gather user feedback, and adjust your approach to improve performance and ROI.

6. Staying Informed

Keep Learning: The field of NLP is rapidly evolving. Attend webinars, participate in forums, and follow thought leaders to stay informed about the latest advancements and tools.

Explore Advanced Applications: As you become more comfortable with NLP, consider exploring more advanced applications, such as machine learning models for predictive analysis or complex natural language understanding (NLU) tasks.

Final Thoughts

Implementing NLP tools for text analysis can significantly enhance your organization’s data analysis capabilities, leading to more informed decision-making and improved outcomes.

By understanding your needs, carefully selecting tools, and measuring success, you can effectively leverage the power of NLP to meet your business objectives.

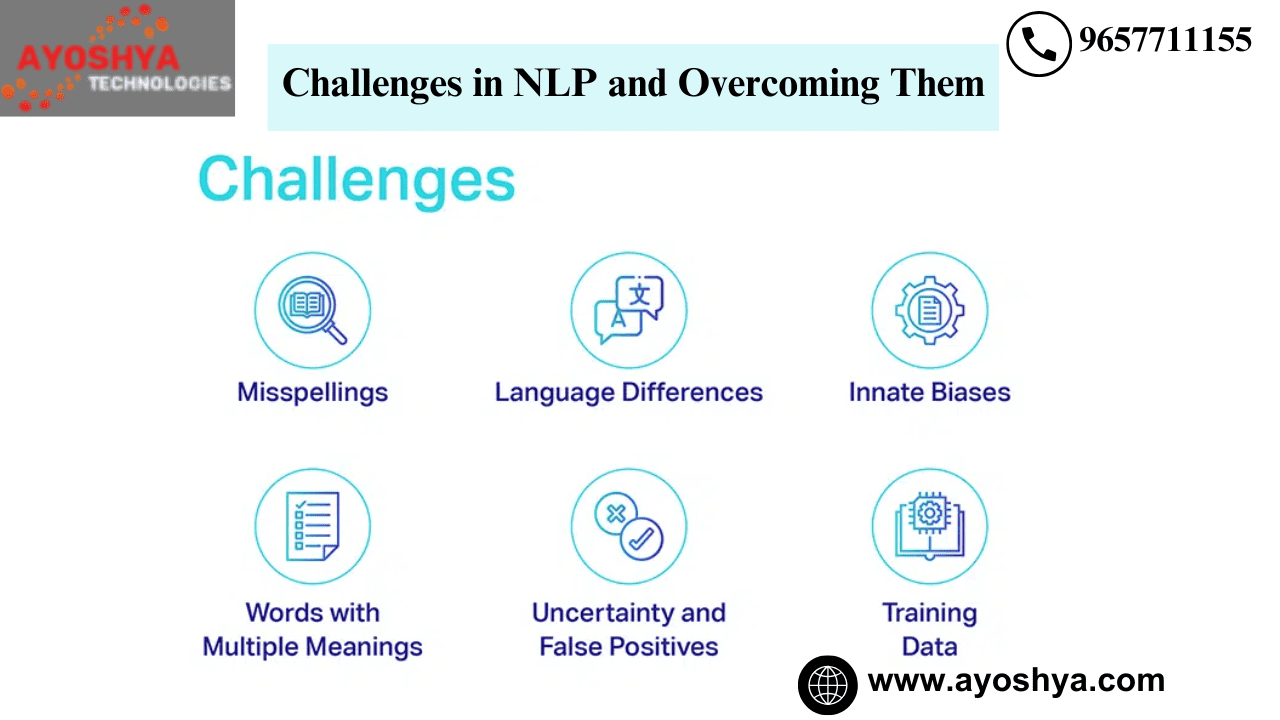

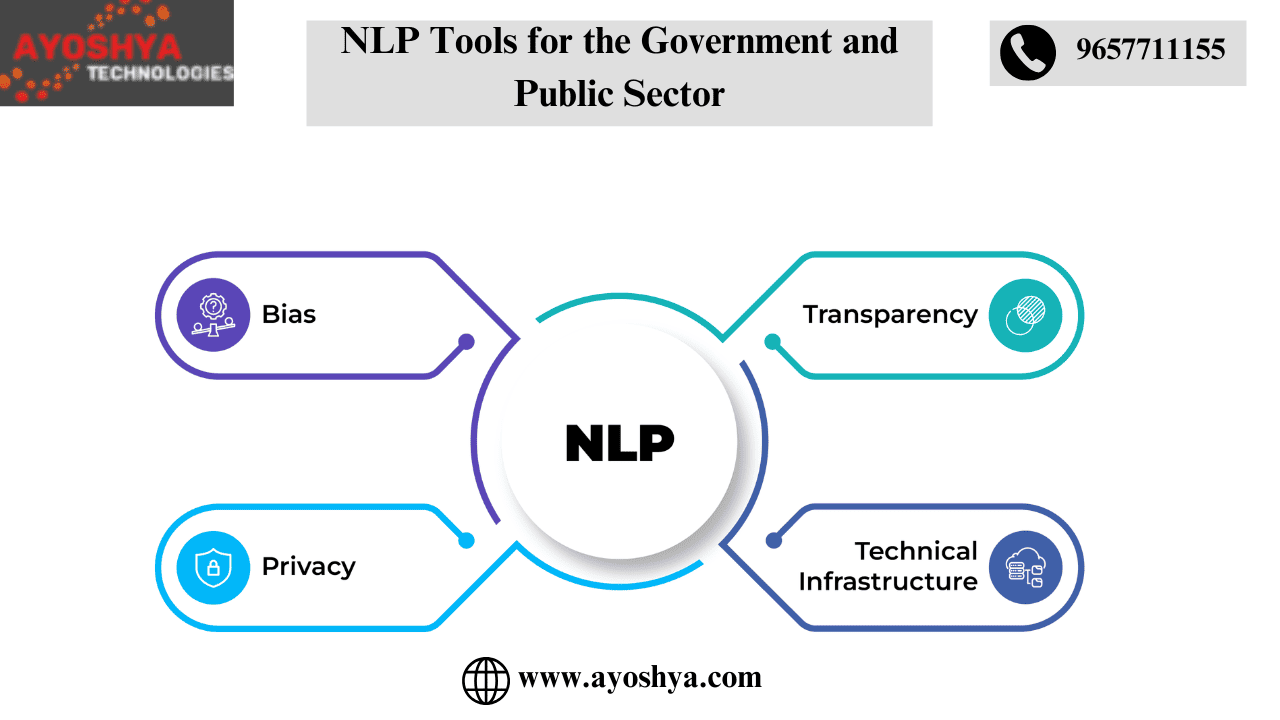

Challenges and Limitations of NLP Tools

Understanding Linguistic Nuances and Context: One of the significant hurdles NLP faces is grasping the subtle layers of human language. This includes:

- Idioms and Metaphors: Phrases whose meanings cannot be determined by their constituent words pose a challenge.

- Cultural References: Texts rich in cultural nuances can lead to misinterpretations without deep contextual understanding.

Moreover, context plays a crucial role in how words are understood, and missing this can lead to inaccuracies in text interpretation.

Interpreting Sarcasm, Irony, and Mixed Sentiments: NLP tools often stumble over text that contains sarcasm or irony, largely because these rely heavily on the tone that is not always apparent in written form.

Similarly, texts that express mixed sentiments—combining positive and negative emotions—can confuse algorithms designed to categorize sentiments in a binary manner.

Privacy and Ethical Considerations: As NLP technologies sift through vast amounts of text data, they inevitably encounter personal information. This raises significant concerns regarding:

- Data Privacy: Ensuring that individual data rights are respected.

- Ethical Use: Balancing the benefits of NLP applications against potential misuse.

Future Trends in NLP for Text Analysis

Advances in AI and Machine Learning: The future of NLP is inextricably linked with the progression of AI and machine learning technologies. We’re looking at:

- Improved algorithms for a deeper and more nuanced understanding of language.

- Enhanced models that can more accurately interpret complex linguistic features.

Real-time Analysis Becoming Crucial: The demand for instant analysis is growing, especially in the business and social media sectors. The capability to assess customer feedback or public sentiment in real-time offers:

- Quick Decision Making: Enabling businesses to respond to market changes swiftly.

- Engagement Optimization: Allowing for immediate engagement with social media trends and conversations.

Evolving Applications in New Fields: NLP’s horizon is expanding into areas previously unimagined, from assisting in healthcare diagnostics to supporting the development of autonomous vehicles. This expansion is facilitated by:

- Diverse Data Processing: The ability to interpret and analyze varied forms of text data.

- Innovative Use Cases: Applying NLP in ways that revolutionize traditional processes across different industries.

By blending technological advancements with evolving needs and applications, NLP is set to overcome its current limitations and unlock new possibilities in text analysis and beyond.

FAQs

What are NLP tools?

NLP (Natural Language Processing) tools are software applications designed to analyze, understand, and interpret human language in text form, automating tasks like text mining and sentiment analysis.

How do NLP tools work?

These tools use machine learning and AI algorithms to process and analyze text data, identifying patterns, sentiments, and linguistic structures.

What is text mining?

Text mining involves extracting meaningful information and patterns from large text datasets, enabling data analysis and decision-making.

Can NLP tools analyze sentiments?

Yes, sentiment analysis is a key feature, allowing these tools to determine the emotions, opinions, and attitudes expressed in text data.

What industries benefit from NLP tools?

Industries such as marketing, finance, healthcare, and research use NLP tools for various applications, including customer feedback analysis and clinical data interpretation.

What challenges do NLP tools address?

NLP tools tackle challenges like interpreting complex linguistic nuances, managing large volumes of data, and addressing privacy concerns in text analysis.

Are NLP tools accurate?

While highly effective, their accuracy can vary based on the tool’s design, the language’s complexity, and the data’s quality.

Can NLP tools integrate with other software?

Key NLP tools are designed for easy integration with various platforms and software applications, enhancing their utility and application.to easily integrate

How do NLP tools handle linguistic nuances?

Advanced algorithms and machine learning models enable these tools to understand and interpret subtleties in language, though challenges remain with sarcasm and ambiguity.

What about privacy concerns with NLP tools?

Developers implement measures to protect sensitive information, and legal frameworks guide their use, but concerns remain a topic of ongoing discussion and improvement.

What future trends are shaping NLP tools?

Trends include integrating more advanced AI and machine learning for real-time analysis, improving accuracy, and expanding capabilities.

Can small businesses benefit from NLP tools?

NLP tools can help small businesses analyze customer feedback, market trends, and more, offering insights that support growth and customer satisfaction.

Do NLP tools require technical expertise to use?

While some technical knowledge can be helpful, many NLP tools are designed with user-friendly interfaces that make them accessible to non-technical users.

How is sentiment analysis useful in marketing?

Sentiment analysis helps marketers understand customer feelings towards products or brands, inform strategies, and improve customer experiences.

What advancements are being made in NLP for healthcare?

In healthcare, NLP advancements focus on extracting patient information from clinical notes and literature, improving diagnosis, treatment planning, and patient care.