SAP PO Orchestra: Part 5 – Process Monitoring and Administration

Process Monitoring and Administration

Throughout this blog series, we’ve explored the intricacies of SAP Process Orchestration (SAP PO), delving into its functionalities and how it orchestrates seamless communication across diverse systems. Now, it’s time to shift gears and focus on the control room – process monitoring and administration. After all, a well-tuned orchestra requires a conductor who vigilantly monitors and ensures a smooth performance.

This blog equips you with the knowledge to effectively monitor and administer your SAP PO landscape, enabling you to proactively identify and address issues, maintaining optimal message flow.

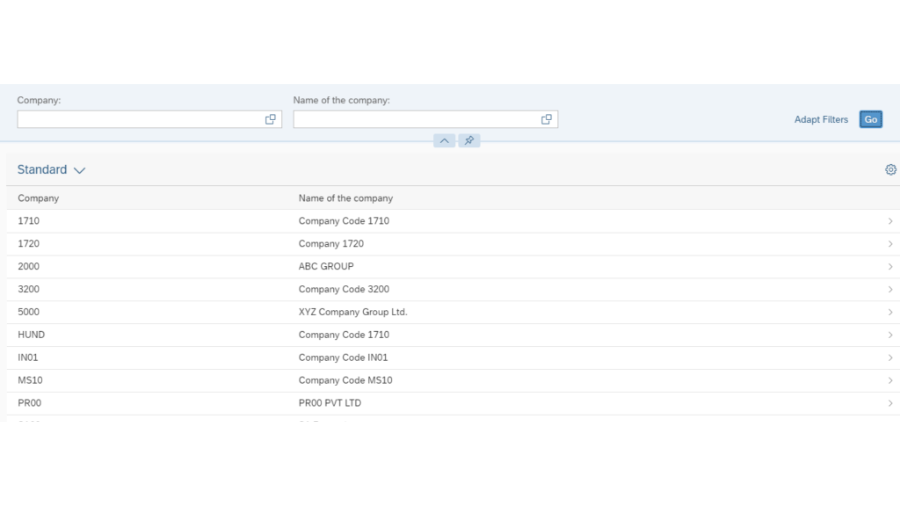

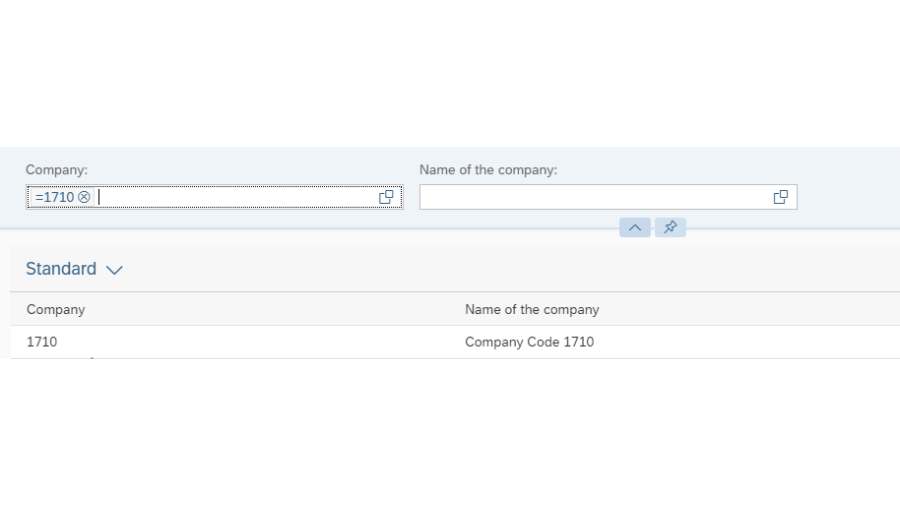

The SAP PO Administration Console: Your Command Center

The SAP PO Administration Console serves as your central hub for system configuration and monitoring. Here’s what you can achieve using this powerful tool:

- System Configuration: Configure communication channels, adapters, and message mappings within the console. You can define how data is exchanged between systems and ensure messages are processed according to your specifications.

- Process Overview: Gain a comprehensive overview of running, failed, and suspended process instances. This allows you to identify potential bottlenecks and troubleshoot issues promptly.

- Detailed Process Monitoring: Drill down into individual process instances to view their execution details, including the current step, processing time, and any errors encountered. This granular visibility empowers you to pinpoint the root cause of problems.

- Alert Configuration: Set up alerts and notifications to be triggered when specific events occur, such as message processing errors or exceeding defined thresholds. This proactive approach enables you to address issues before they significantly impact your integration landscape.

By mastering the SAP PO Administration Console, you gain the power to fine-tune your integration processes, ensure smooth message flow, and maintain optimal system performance.

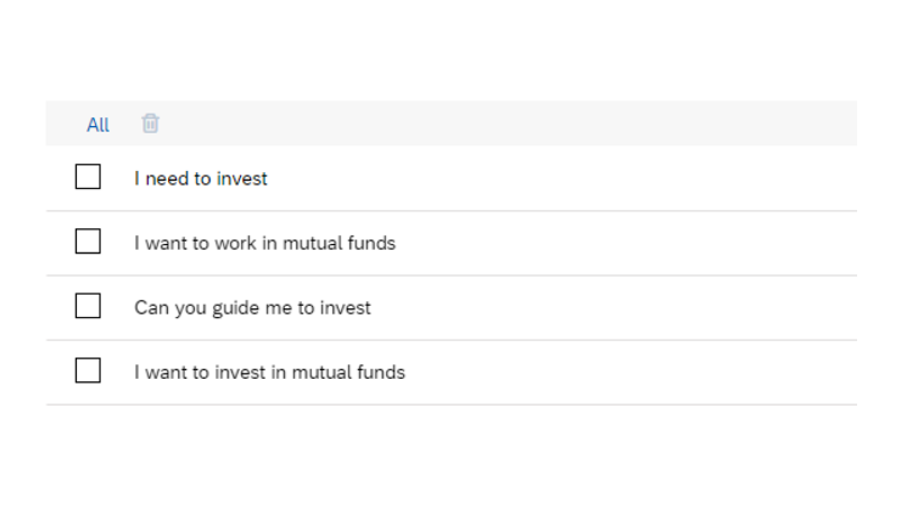

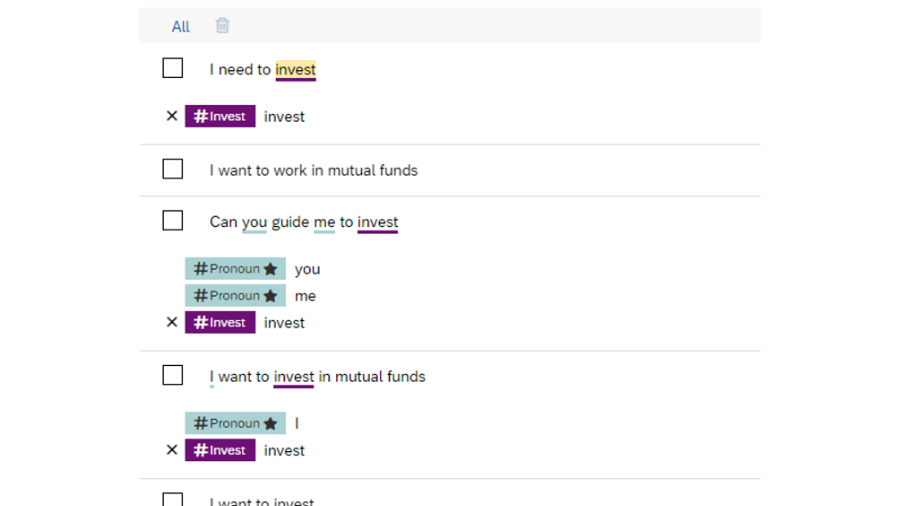

Message Monitoring Tools: Keeping an Eye on the Data Flow

SAP PO provides a comprehensive suite of message monitoring tools that offer invaluable insights into message processing:

- Message Monitoring: This tool provides a detailed view of individual messages as they travel through the integration flow. You can track message status (sent, received, processed), identify any errors encountered, and analyze processing times.

- Channel Monitoring: Monitor the health and performance of your communication channels. This allows you to identify potential connectivity issues or bottlenecks within your communication infrastructure.

- Adapter Monitoring: Gain insights into the performance of your adapters, which facilitate communication between SAP PO and external systems. By monitoring adapter behavior, you can ensure seamless data exchange across your landscape.

Utilizing these message monitoring tools empowers you to proactively identify and address issues that could hinder message flow within your SAP PO environment.

Setting the Stage for Proactive Issue Detection with Alerts

Imagine an orchestra conductor relying solely on the audience to point out mistakes. Proactive issue detection is crucial in SAP PO. Here’s how alerts and notifications come into play:

- Alert Configuration: Define alerts for specific events like message processing errors, exceeding retry attempts, or prolonged processing times. This allows for early detection of potential issues before they snowball into major disruptions.

- Notification Channels: Configure notification channels to receive alerts via email, SMS, or integrate them with monitoring dashboards. This ensures you’re notified promptly, regardless of location, allowing for swift intervention.

By implementing a robust alerting system, you can maintain a proactive approach to monitoring your SAP PO environment, minimizing downtime and ensuring smooth message flow.

Security Considerations and User Management

Security is paramount in any IT landscape. Here are some key considerations for securing your SAP PO environment:

- User Access Control: Implement user roles and permissions to restrict access to sensitive data and functionalities within the SAP PO Administration Console. This ensures only authorized users can make configuration changes.

- Data Encryption: Utilize encryption techniques to safeguard sensitive data at rest and in transit. This minimizes the risk of data breaches and unauthorized access.

- Regular Security Audits: Conduct periodic security audits to identify and address potential vulnerabilities within your SAP PO system. This proactive approach strengthens your overall security posture.

By prioritizing security considerations and implementing user management best practices, you can create a secure environment for your SAP PO processes and data exchange.

Conclusion

Process monitoring and administration are the cornerstones of a well-functioning SAP PO landscape. By leveraging the SAP PO Administration Console, message monitoring tools, a robust alerting system, and prioritizing security, you gain the power to proactively manage, monitor, and maintain your integration processes. This ensures smooth message flow, minimizes downtime, and empowers your SAP PO environment to operate at peak performance, fostering seamless communication across your entire IT ecosystem.

It might be helpful: