SAP Adobe Interactive Form Tutorial Part V Images Graphics and Logo in Adobe Forms

oday, we will learn how to incorporate a logo into an Adobe Form output in “SAP Adobe Interactive Form Tutorial Part V: Images, Graphics, and Logo in Adobe Forms.”

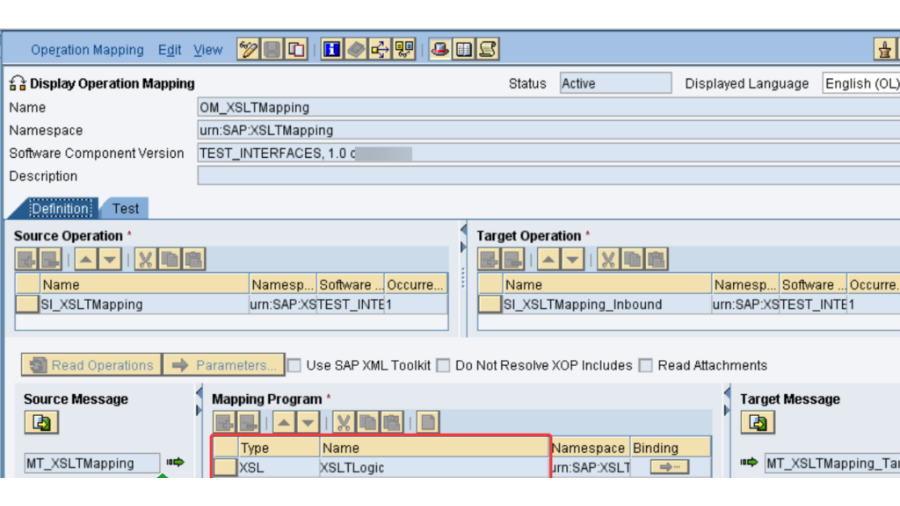

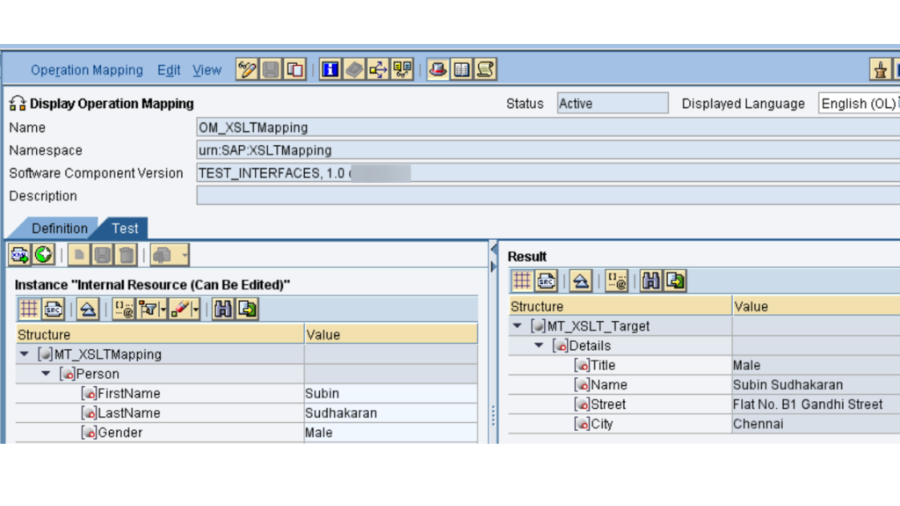

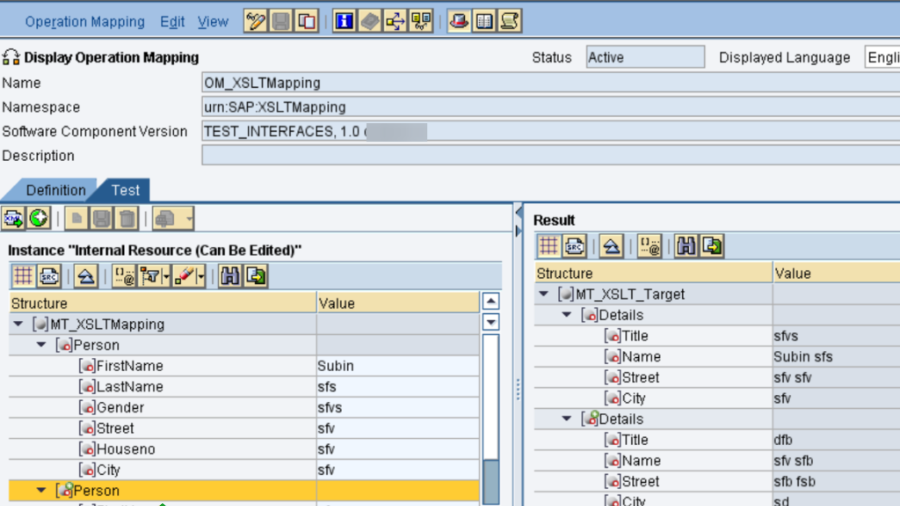

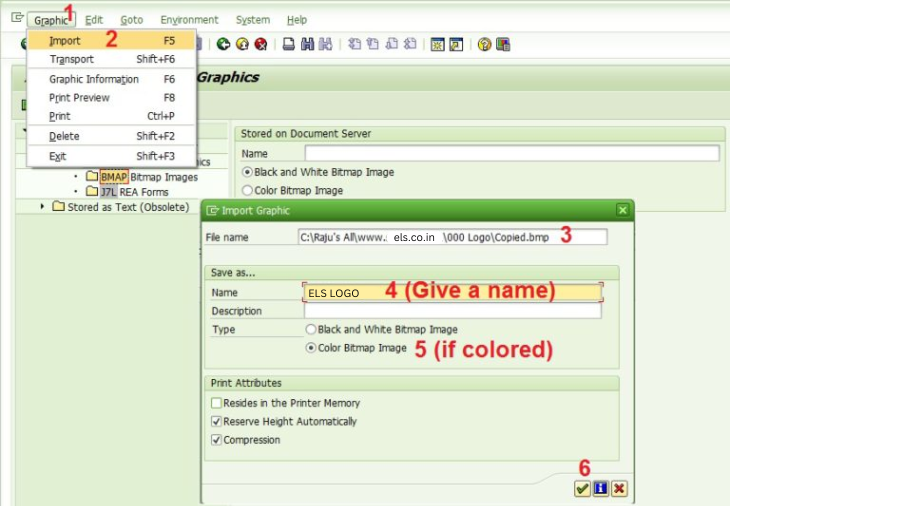

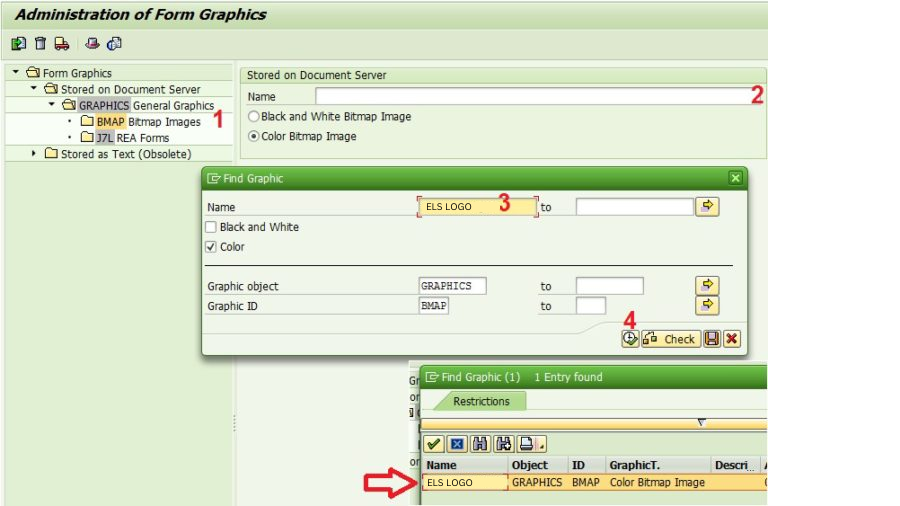

Pre-requisite: We need to upload the required logo or image as shown below in T-code SE78, similar to the process we follow for Smartforms.

When you transfer the image to SAP from your PC or local machine, please remember to validate it in T-code SE78. This step ensures that the logo or image is properly stored in the SAP system. For more detailed steps, you can refer to “SAP Form Tutorial Part V: Images, Graphics, and Logo in Adobe Forms“ to understand how to work with images and graphics in Adobe Forms.

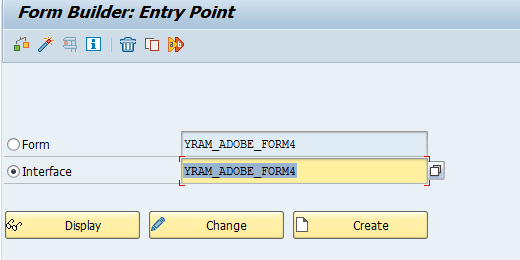

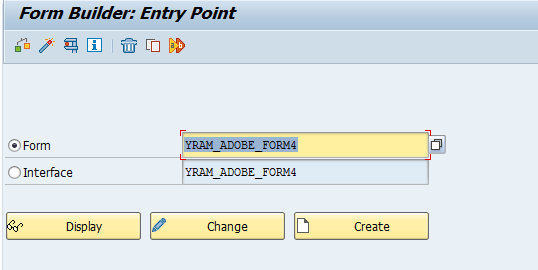

Prepare the Form Interface

Transaction Code: SFP. Enter the interface name and create (interface is mandatory for Adobe Form). In this SAP Adobe Interactive Form Tutorial Part V: Images, Graphics, and Logo in Adobe Forms, we will explore how to incorporate visual elements such as images, graphics, and logos into your Adobe Forms to enhance the user experience and provide a polished look to your outputs.

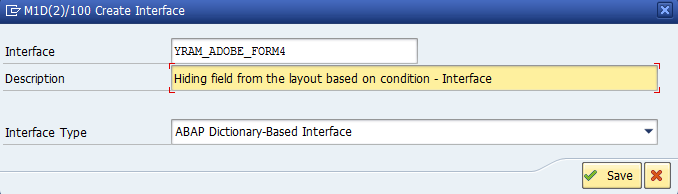

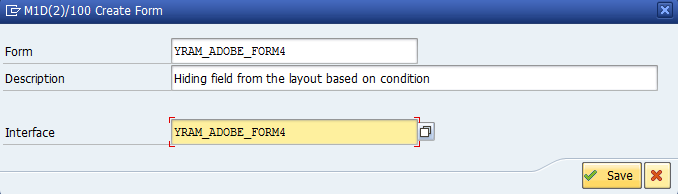

Enter the short description and Save.

Enter the Package name and Save.

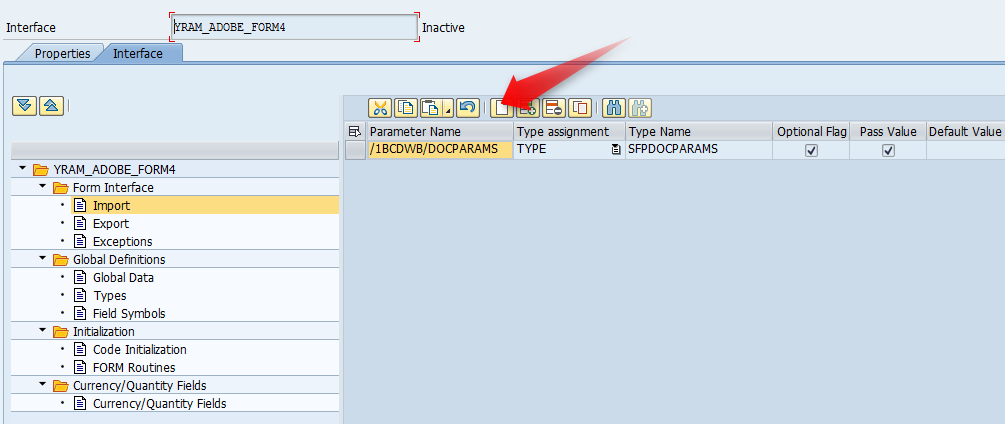

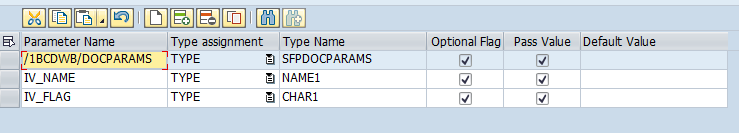

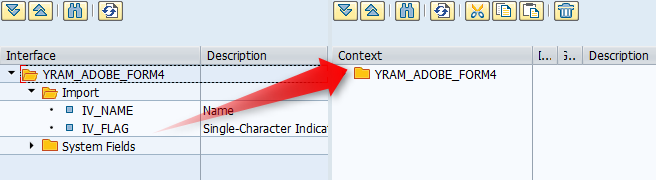

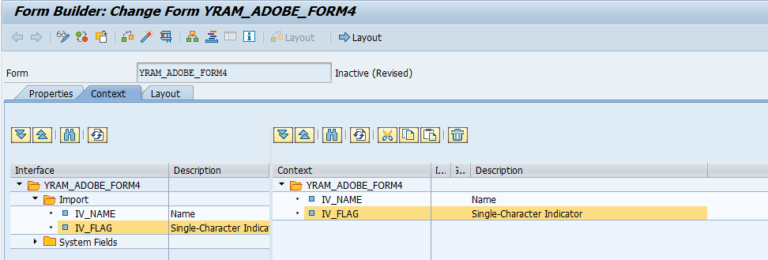

Allow us to add our own custom Boundary Name for the picture/logo. Select the Import choice under Structure Connection point (left side) and press the Make button (right side) to add a Bringing in Boundary.

Please note: IV_LOGO is of type XSTRING (Data Type).

Save, Check and Enact the Connection point.

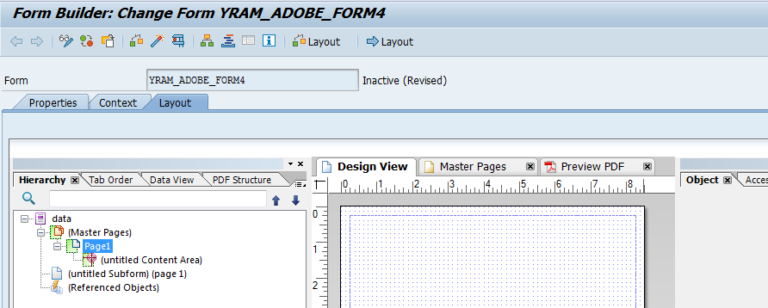

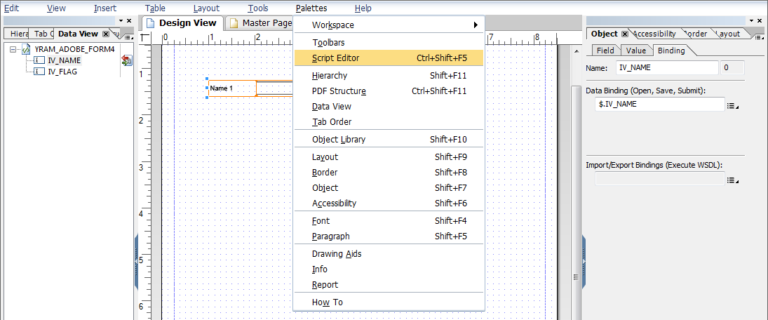

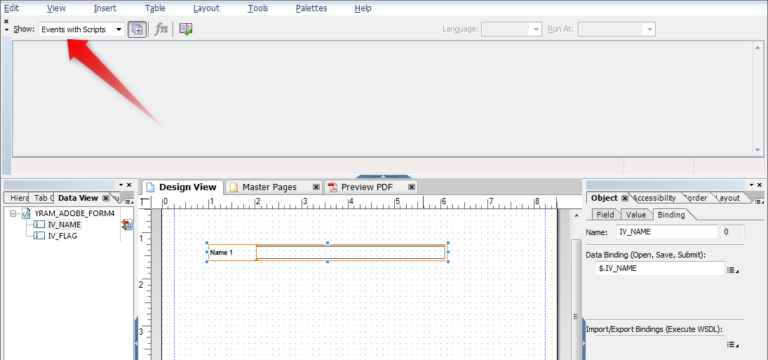

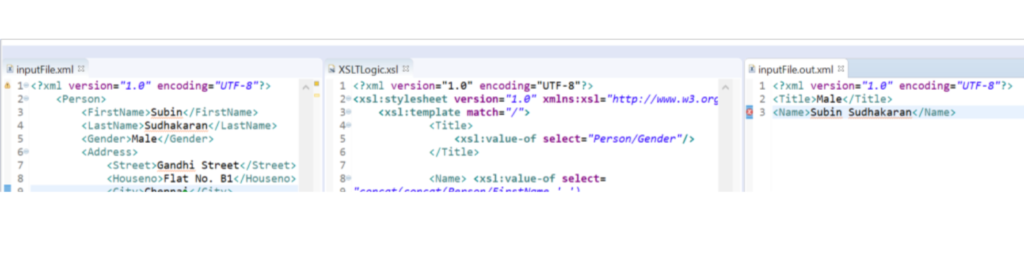

Design the Form Layout

Go to back SFP Exchange principal screen. Make the structure.

Press on make button. Give the short depiction and point of interaction name that you have made before.

Enter the bundle name and save.

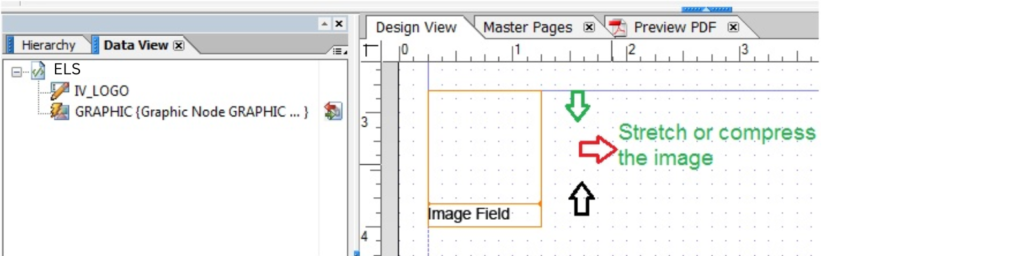

Drag IV_LOGO from the point of interaction that we made before and drop them to the setting region.

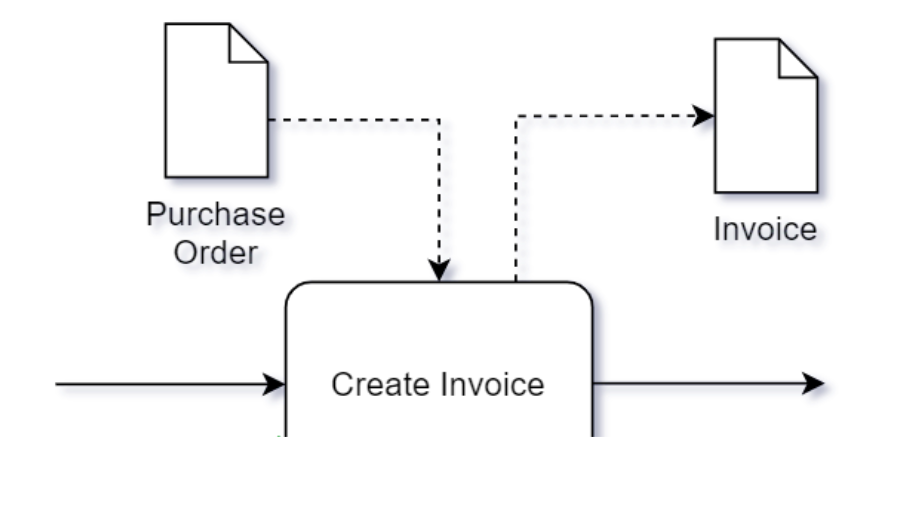

Right-click on the YRAM_ADOBE_FORM5 under the specific circumstance and create a graphic.

Important step: Change the Graphic type from Graphic Reference to Graphic content

Hit return key/enter key.

Select Yes option.

Enter Field as IV_LOGO (or whatever name you have given above)

And MIME Type as ‘IMAGE/BMP’.

Save.

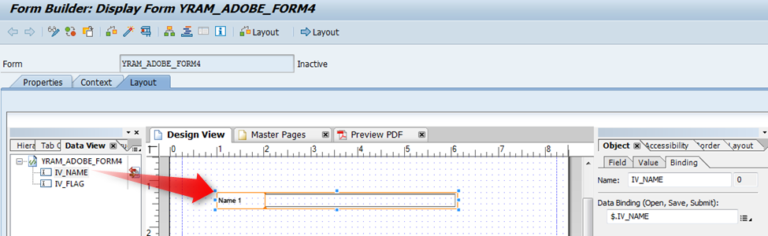

Go to Design. Pick the Information View Tab. Simplified the Realistic on the design.

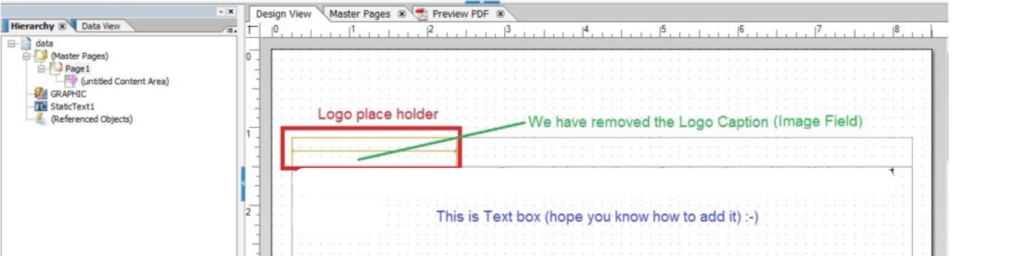

You can expand or accumulate your logo as per your need. You ought to dispense with the logo engraving for instance the default Picture Field text. This Image Field text is a respectable spot to make the motto out of the association/logo if you have any. Else we can leave it clear.

We have added one more text component beneath the logo for showing reason.

Check, Save and Actuate. Our Design with a Realistic and Structure Point of interaction is finished. Did you notice, we have two components in our format. The logo field and the realistic substance. It tends to be contrasted with the variable name and the real satisfied.

Driver Program to call the Adobe Form

You can use the below code as a reference to plug and play for printing the logo.

*&---------------------------------------------------------------------*

*======================================================================*

* YRAM_ADOBE_FORM_PROGRAM5 *

*======================================================================*

* Project : SAP Adobe Forms Tutorial *

* Author : Varad (www.elearningsolutions.co.in) *

* Description : Printing a logo in the adobe form *

*======================================================================*

REPORT yram_adobe_form_program5.

*======================================================================*

* Selection Screen

*======================================================================*

PARAMETERS : p_logo TYPE rstxt-tdname.

*======================================================================*

* Data Objects

*======================================================================*

DATA: gv_fm_name TYPE rs38l_fnam, " FM Name

gs_fp_docparams TYPE sfpdocparams,

gs_fp_outputparams TYPE sfpoutputparams,

gv_name TYPE tdobname,

gv_logo TYPE xstring ,

gv_bmp TYPE xstring.

*======================================================================*

* Constants

*======================================================================*

CONSTANTS : gc_btype TYPE tdbtype VALUE 'BCOL',

gc_id TYPE tdidgr VALUE 'BMAP',

gc_object TYPE tdobjectgr VALUE 'GRAPHICS',

gv_form_name TYPE fpname VALUE 'YRAM_ADOBE_FORM5'.

*======================================================================*

* START of Calling the Form

*======================================================================*

*&---------------------------------------------------------------------*

**&&~~ Form Processing: Call Form - Open

*

CALL FUNCTION 'FP_JOB_OPEN'

CHANGING

ie_outputparams = gs_fp_outputparams

EXCEPTIONS

cancel = 1

usage_error = 2

system_error = 3

internal_error = 4

OTHERS = 5.

IF sy-subrc <> 0.

" Suitable Error Handling

ENDIF.

*&---------------------------------------------------------------------*

**&&~~ Get the Function module name based on Form Name

*

CALL FUNCTION 'FP_FUNCTION_MODULE_NAME'

EXPORTING

i_name = gv_form_name

IMPORTING

e_funcname = gv_fm_name.

IF sy-subrc <> 0.

" Suitable Error Handling

ENDIF.

* Passing the logo name

gv_name = p_logo.

* Get the image/logo graphic information

CALL METHOD cl_ssf_xsf_utilities=>get_bds_graphic_as_bmp

EXPORTING

p_object = gc_object " GRAPHICS

p_name = gv_name " Name of the Logo

p_id = gc_id " BMAP

p_btype = gc_btype " BCOL for color, 'BMON' for Black & White

RECEIVING

p_bmp = gv_bmp

EXCEPTIONS

not_found = 1

internal_error = 2

OTHERS = 3.

gv_logo = gv_bmp.

*&---------------------------------------------------------------------*

**&&~~ Take the FM name by execuing the form - by using Pattern-

**&&~~ call that FM and replace the FM Name by gv_fm_name

**&&~~ Call the Generated FM

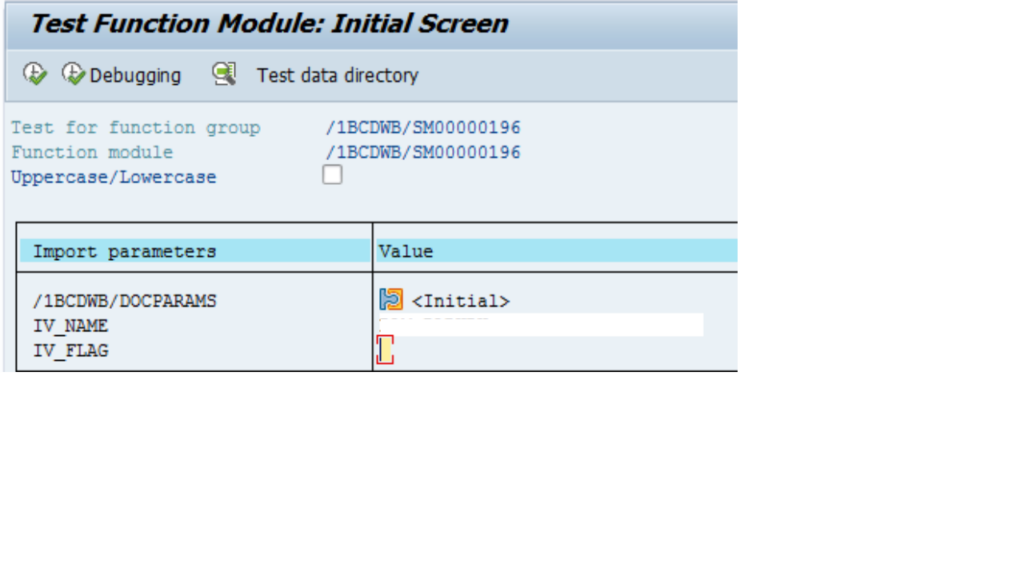

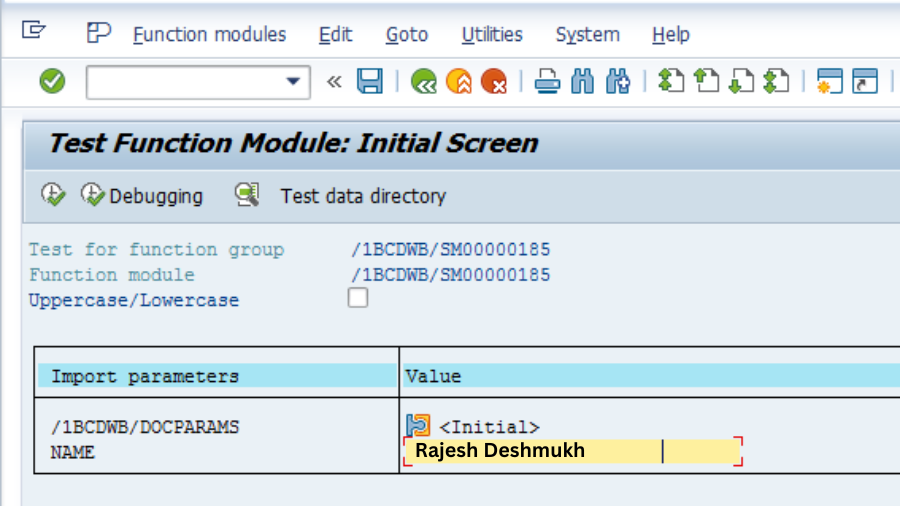

CALL FUNCTION gv_fm_name

EXPORTING

/1bcdwb/docparams = gs_fp_docparams

* iv_name = p_name

* iv_flag = p_flag

iv_logo = gv_logo

EXCEPTIONS

usage_error = 1

system_error = 2

internal_error = 3

OTHERS = 4.

IF sy-subrc <> 0.

* Implement suitable error handling here

ENDIF.

*&---------------------------------------------------------------------*

*&---------------------------------------------------------------------*

*&---- Close the spool job

CALL FUNCTION 'FP_JOB_CLOSE'

EXCEPTIONS

usage_error = 1

system_error = 2

internal_error = 3

OTHERS = 4.

IF sy-subrc <> 0.

* <error handling>

ENDIF.

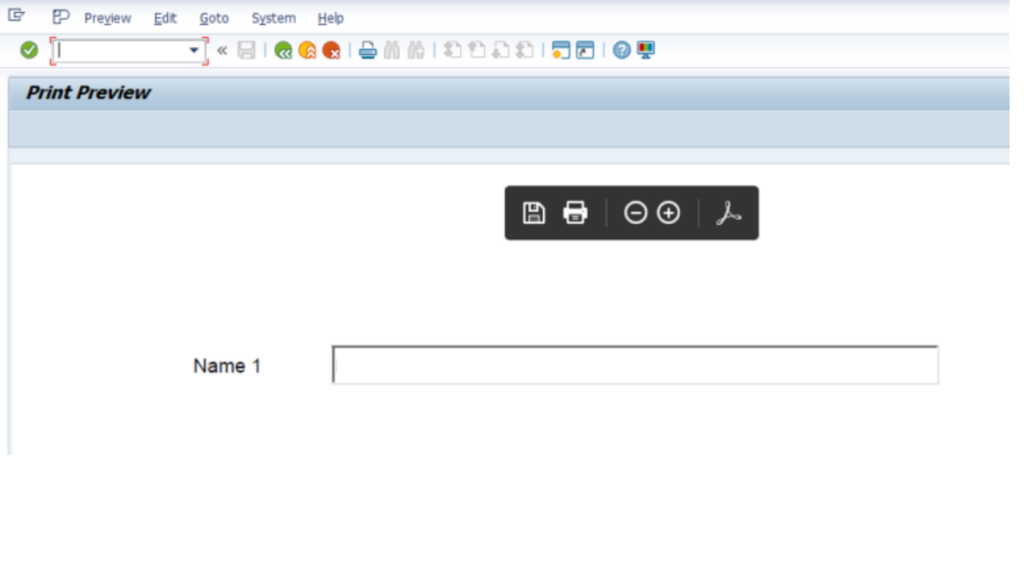

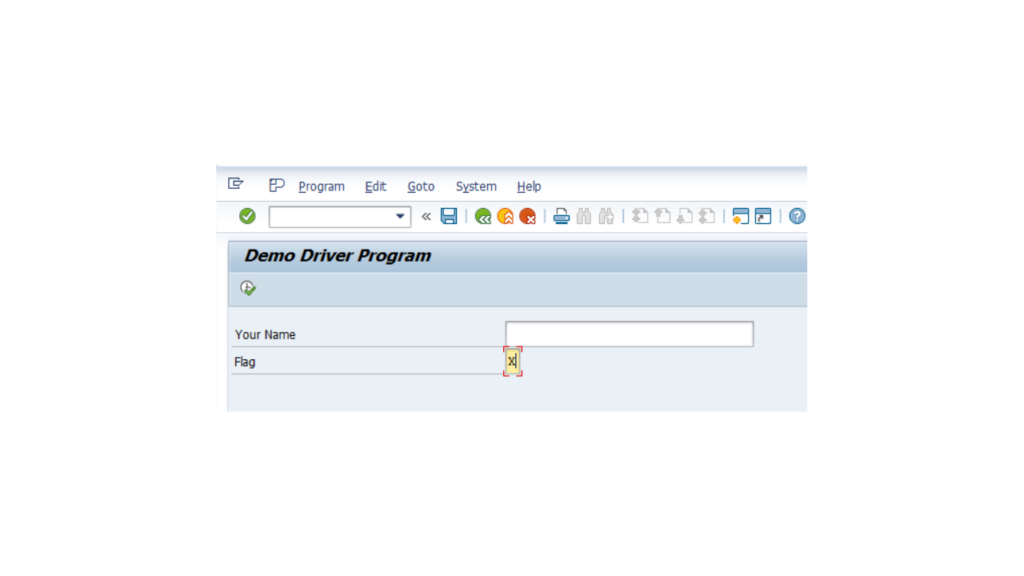

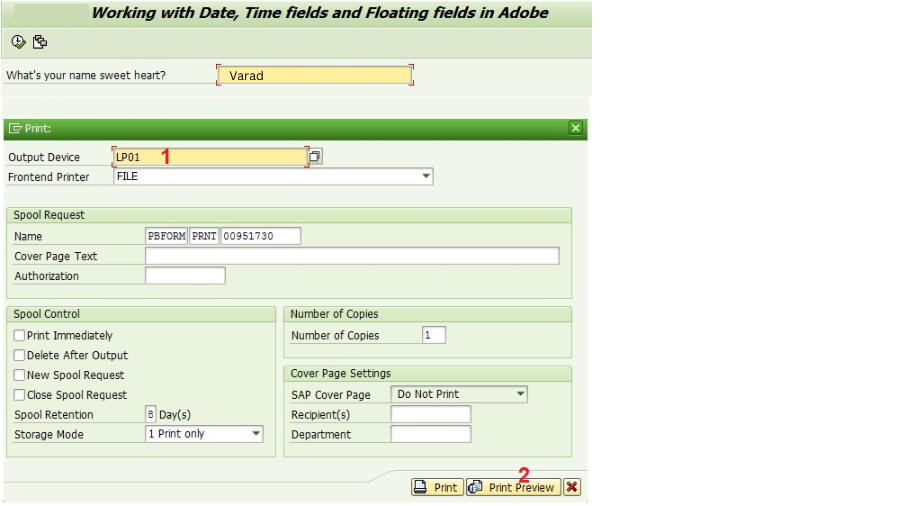

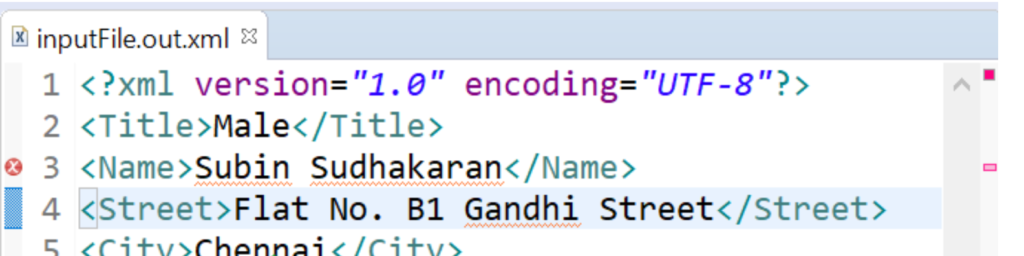

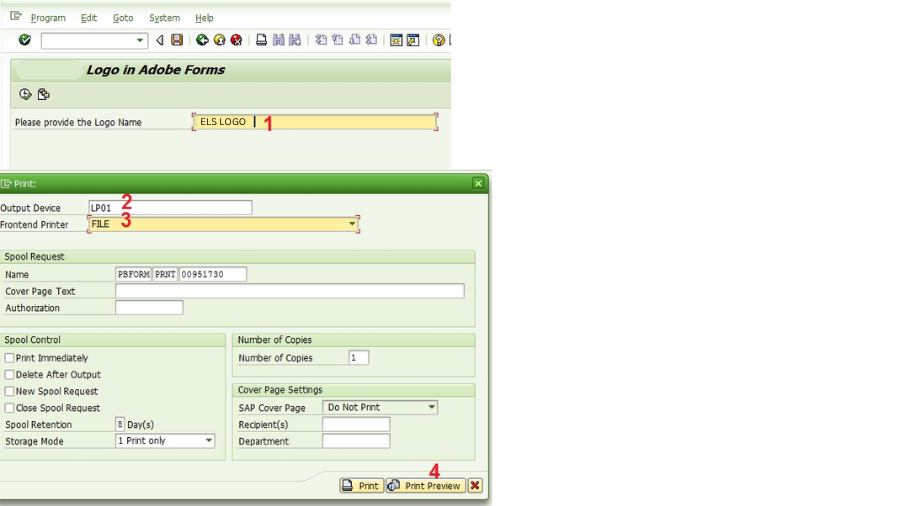

Let us Test our baby

Execute Program : YRAM_ADOBE_FORM_PROGRAM5

Give the picture/logo name which we transferred in SE78 or some other logo name which is now accessible in SAP framework. We would use ELS Logo.

If it’s not too much trouble, actually take a look at the program above. The logo property is powerfully acquired from the picture name and took care of to the SAP Adobe Structure. You can include any picture you need from your SAP Adobe Interactive framework. The program would deal with it consequently to acquire the mark of the picture and pass it accurately to the Adobe Structure.

Press on Print see and view the result with your picture.

YOU MAY BE INTERESTED IN